A whisky cask could be a nice different asset, splendid for a long run funding the place you’re pleased to lock the cash away for ten or extra years. Buyers in scotch whisky have made something from just a few thousand {dollars}, as much as the costliest privately owned cask of whisky ever offered publicly, a cask of Macallan that made greater than $1,295,000 (£1,017,000) in 2022.

In fact, it’s necessary to comprehend not everyone seems to be lucky sufficient to purchase the subsequent Macallan! You could have sensible expectations of cask funding in addition to a very good understanding of how the market works so that you simply don’t get caught out in a rip-off.

When you suppose {that a} cask of whisky is perhaps the correct funding for you, what else do it’s worthwhile to know earlier than you spend money on 2024?

What’s The Distinction Between Whiskey and Whisky

Earlier than we get began on our 5 cask funding ideas for 2024, it’s necessary to make clear that once we discuss investing in whisky casks we’re typically talking about buying and holding casks of scotch whisky. Scotch have to be distilled and matured in Scotland and is a longtime world luxurious standing image, which helps give it the long run potential as an asset. There may be nothing inherently improper with shopping for casks of whisky or whiskey from different nations, however do your analysis earlier than committing, as a result of they don’t seem to be the identical asset with the identical potential.

The Whiskey Wash is now owned by Mark Littler LTD who’ve been huge advocates for extra client safety throughout the trade. Littler additionally partnered with whisky author and Keeper Of The Quaich Felipe Schrieberg to create protectyourcask.com. We might be sharing extra info on cask possession on The Whiskey Wash sooner or later, however within the meantime if you’re taken with studying and studying extra about investing in casks of whisky head to marklitter.com

One: Perceive Possession

Right here’s the necessary half in short: in the event you “purchase” a cask with out a supply order, you don’t really personal that cask on the warehouse stage and may’t be sure the cask exists or is what your vendor says it’s.

The only largest method that scammers now and traditionally have labored is by promoting casks that don’t exist, promoting the identical cask a number of occasions or by promoting a special cask to the one you suppose you got. This will all be executed when casks are “purchased” and not using a supply order.

What can we imply by a supply order? The Scotch Whisky Association describe a supply order as “a doc setting out the small print of the cask to be transferred, signed by purchaser and vendor after which delivered to the warehouskeeper.”

A supply order is the trade commonplace method of shopping for and promoting casks. However for you as a personal particular person a supply order does two necessary issues. Firstly, a supply order transfers the cask into your title on the warehouse stage, so you really personal the cask. Secondly, and simply as importantly, it acts as a verification from a HMRC licensed third celebration that the cask is what the vendor says it’s.

The opposite factor about not getting a supply order is that it means another person technically owns that cask on the warehouse. In all chance it’s going to stay within the title of whoever you invested with, as an asset on their books, and of their management. However often it could really be below the title of another person utterly… The purpose right here is that if you’re shopping for this fashion it’s worthwhile to belief that firm implicitly. You additionally must be sure they’ll be there in 10 or extra years once you come to promote.

If whoever you’re shopping for a cask from says you don’t want a supply order, or can’t get one and not using a WOWGR then this is a sign that they both don’t know the trade or are deceptive you. Neither are good indicators for a vendor or agent!

Two: Be In It For The Lengthy Time period

If I may have picked two factors to be my tip primary this is able to have been joint with supply orders. Since you may be scammed or lose your cash in the event you don’t get the cask in your title, however you undoubtedly gained’t make any cash in the event you strategy casks as a brief or medium time period funding.

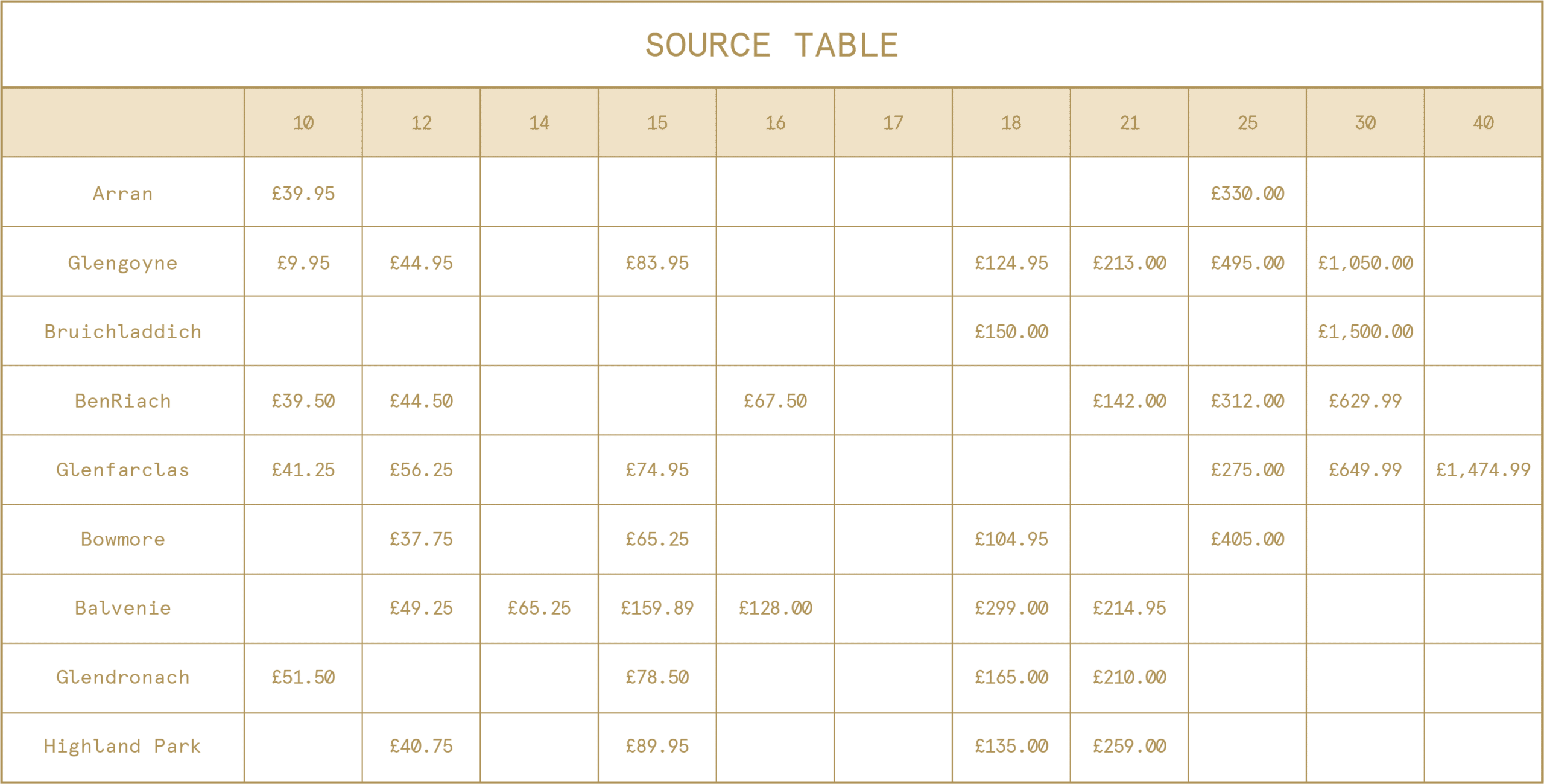

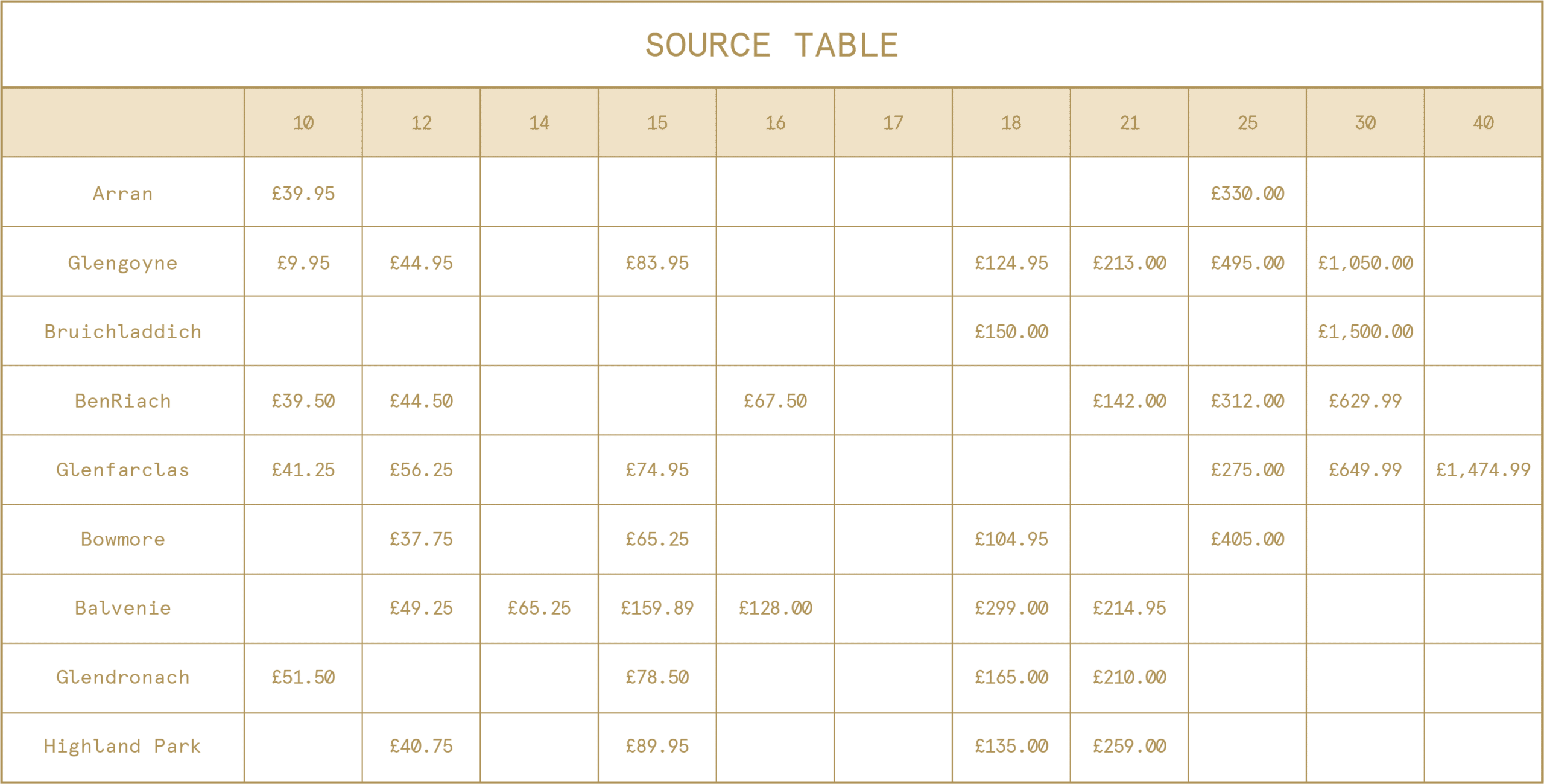

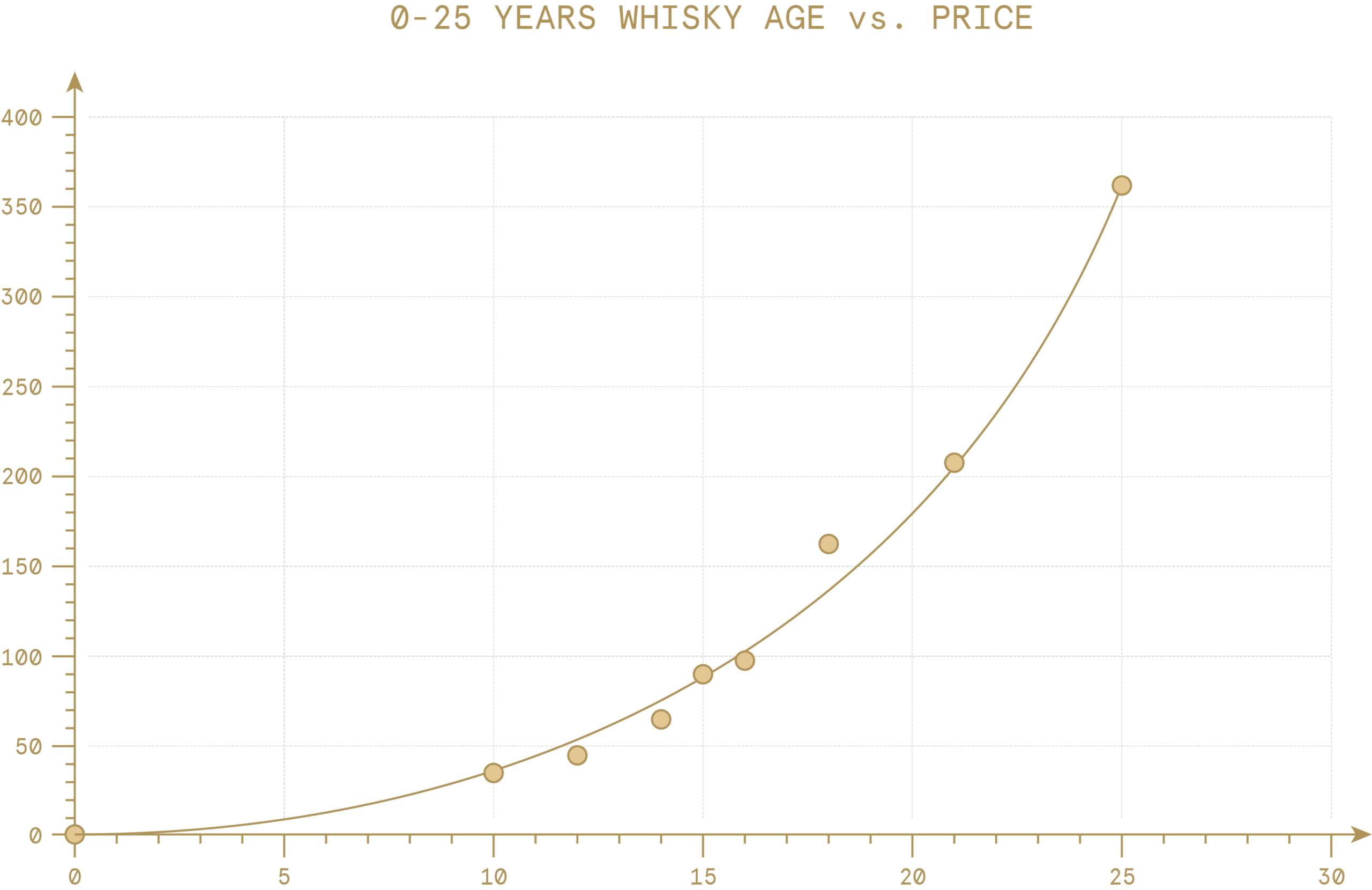

Whisky turns into a premium product round 18 years previous. We seemed on the common bottle costs of various whiskies to create the beneath graph to indicate how the worth of whisky modifications with age. You shouldn’t divide a cask value by the variety of bottles to worth a cask (due to taxes concerned in getting whisky right into a bottle), however as all casks might be bottled ultimately, the form of the curve can act as a very good indicator as to the trail of the worth of scotch whisky in a cask.

The graph reveals what you may see once you have a look at the worth of scotch in your native liquor retailer; whisky turns into classed as a premium product round 18 years previous. So if you wish to make a revenue then it’s worthwhile to at the least goal for this age. The supply desk is on the finish of this text.

As most individuals purchase casks as new fill, then this implies an 18 12 months funding to get the most effective returns. You should purchase barely older “younger” whisky aged 3 to 10 years previous to get your funding timeframe down however the absolute minimal it’s best to goal for continues to be round 10 years.

In fact, generally circumstances change, and it’s possible you’ll have to promote earlier. However typically talking, in the event you don’t count on you may tie your cash up for at the least 10 years—however ideally no matter timeframe it’s worthwhile to get the cask to 18—then we wouldn’t counsel taking a look at casks as an funding.

Three: Get Naming Rights

Naming rights management how business your cask might be once you come to promote it, however what can we imply by “naming rights?”

In Scotland distillery names are often model names, which suggests impartial bottlers have to stick to trademark legislation when naming their bottles. Casks with naming rights can ultimately be bottled with the geographically appropriate assertion “distilled on the XYZ distillery.”

Some casks are offered by the distillery with out naming rights, which suggests they’ll’t carry the distillery model title if they’re bottled as a single malt. Usually these are offered below completely different non-trademarked names, which individuals know are related to a sure distillery, however they nonetheless don’t have naming rights and that’s what is necessary for the tip worth of your cask.

Why? As a result of the worth of whisky as a single malt is tied to the model of the distillery the place it was distilled. Whereas somebody with trade data might know that Whitlaw was distilled at Highland Park or Staoisha was distilled at Bunnahabhain, your common client is not going to, which makes that whisky price much less when it will definitely finally ends up bottled on a shelf. As all casks will ultimately be bottled a scarcity of naming rights places an actual constraint on the potential of a cask as an funding.

What’s extra, there isn’t a trademark safety for secondary names, which provides extra threat for casks with out full naming rights. A great instance is Bunnahabhain, which used to make use of the title of the loch behind the distillery for its casks with out naming rights, the loch known as Ardnahoe. Quick ahead just a few years and the Ardnahoe distillery arrange and trademarked that title. The Bunnahabhain casks offered with the Ardnahoe title are actually solely valued as mixing whisky, which makes them a very completely different proposition to investing in a cask of named single malt whisky.

4: Keep Away From The Heard

Shortage is without doubt one of the essential drivers of worth for scotch whisky casks. Model and high quality are necessary, however as with all the things, if there may be plenty of it in the marketplace then that may restrict your potential once you come to exit.

In case you are seeing the identical or comparable casks offered by means of a number of brokers then it’s seemingly that there are plenty of them in the marketplace. It will influence your potential returns once you come to promote your cask, so hold that in thoughts when trying to find the correct cask/dealer.

By the way, these casks are known as ‘testicles’ within the commerce, as each man in Scotland has two of them.

5: Hold Up To Date With Market Information

As with all investments, educating your self concerning the market and maintaining with trade information might help you make choices. New releases, choices about investments and new markets opening up for a model will all have impacts on potential. Staying abreast of this info might help you choose the correct time to take a position, and to exit.

Be sure you subscribe to The Whisky Wash Publication to maintain updated with the most recent information and developments. You may also subscribe to the YouTube Channel of Mark Littler, Editor in Chief of The Whiskey Wash, the place he repeatedly posts movies about whisky bottle and cask investments, give it a comply with.